Table of Contents

I. Introduction

II. Capitalizing on Market Crises

III. The Merit of Investing in Fundamentally Strong Companies

IV. Identifying the Future of Technology

V. The Art of Timing and Risk Management

VI. Navigating Success

VII. The Role of Single Stocks in a Diversified Portfolio

I. Introduction

The allure of making a fortune in the stock market is a dream shared by many, yet the path to such success is often clouded by get-rich-quick schemes and promises of easy wealth. As a financial advisor who has navigated the tumultuous waters of stock investing to identify significant opportunities, such as Nvidia in late 2022, I aim to share insights that go beyond the conventional wisdom. Our journey into Nvidia's investment landscape during one of the market's most challenging periods underscores the potential for identifying remarkable growth opportunities amidst adversity.

II. Capitalizing on Market Crises

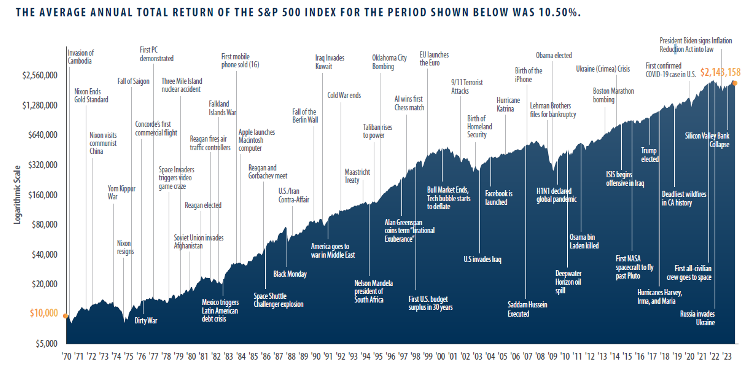

Our strategic investment in Nvidia during the third and fourth quarters of 2022 was a decision made against the backdrop of a historically challenging market. What was funny about the timing, is that had you turned on CNBC, nearly all commentary was about the bear market and how it would last forever. Remember, CNBC is in the business of selling screen time, and the message “bear market could continue for a long time, how to prepare” is much more captivating than “the market is having a pretty bad bear market but don’t worry, it’ll come back”. The chart below is a superb example of just that. Time and time again, the stock market has withstood the test of time. Elections, wars, and pandemics can cause dips in the market. However, the market’s resiliency is a key perspective to maintain.

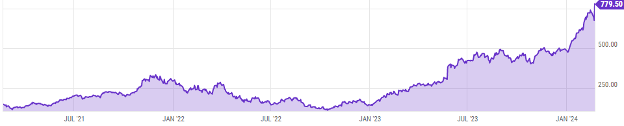

While the so-called "magnificent 7" tech giants saw their values halved, Nvidia's stock plunged over 60%

Fig 1. Shows the share price of Nvidia as of 2/22/2024.

III. The Merit of Investing in Fundamentally Strong Companies

In the quest for the next groundbreaking technology, it's easy to overlook established companies facing temporary setbacks. Nvidia, with its innovative leadership and foundational role in the semiconductor industry, exemplified a great company that was momentarily undervalued due to market dynamics and its association with the cryptocurrency sector. History showed us that Nvidia had rebounded from similar downturns, reinforcing our confidence in its resilience and growth potential. Warren Buffet would be proud that we were being greedy while others were fearful and fearful while others were greedy.

IV. Identifying the Future of Technology

Our conviction in Nvidia was further bolstered by recognizing the semiconductor industry's pivotal role in shaping the future. Inspired by insights from the book "Chip Wars," we understood that semiconductors are to the 21st century what oil was to the 20th. This perspective, coupled with the emerging dominance of artificial intelligence and the increasing reliance on advanced chips across various sectors, highlighted Nvidia's potential for significant growth.

V. The Art of Timing and Risk Management

One lesson I have learned over the years is that we don’t have to perfectly time tops and bottoms to be successful. Once I thought that Nvidia would be a strong investment, I initiated a position (after all it was already down quite a bit) and added to it over the next few months as the stock fluctuated. Timing the market has proven to be impossible and it is even harder with individual stocks. I no longer try to be perfect; My goal is to be among the initial 20% of individuals who identify and execute during opportune times.

Additionally, even when you have identified a wonderful opportunity with lots of upside, do not bet the farm! All too often the market can stay irrational longer than you can stay solvent.

VI. Navigating Success

For those who joined us in investing in Nvidia in 2022, the challenge now lies in managing the significant gains achieved. While navigating the complexities of portfolio diversification, tax planning, and incremental profit-taking, it's crucial to remember the lessons of history and the cyclicality of the markets.

VII. The Role of Single Stocks in a Diversified Portfolio

In an era dominated by passive investing, single stocks like Nvidia offer a compelling opportunity to enhance portfolio performance. However, success in this arena requires adherence to disciplined investment practices and a commitment to ongoing risk management.

I advocate for the importance of partnering with an advisor who embodies competence, compassion, and integrity. As we continue to navigate the complexities of the stock market and seek out the next Nvidia, our professional partnership will guide you toward informed, strategic decisions and, ultimately, achieving your financial goals.

Remember, while the journey to finding the next big stock pick is fraught with challenges, it is also rich with opportunity. With the right approach, informed by experience and a deep understanding of market dynamics, achieving significant returns is not just a possibility but a tangible goal. Let's embark on this journey together, equipped with the insights and strategies that have guided us to success in the past.