TABLE OF CONENTS

IntroductionI. Averages are Deceiving

II. Headlines

III. The Market and Emotions

IV. The Importance of Planning

V. Fear vs. Greed

Conclusion

The Modern Market Roller Coaster

The weather is starting to cool here in the Sunshine State. Eager to see the beginning shift in our southern seasons, my wife and I took this opportunity and brought our kids to a deluge of Orlando theme parks recently.

As my family stood near the exit of one of the most fear-inducing rides, I saw a group of people sick to their stomachs from the turns and drops of the roller coaster. There was a second of pity for these victims of self-induced G-force trauma before my mind turned to a memory of an old colleague. He once similarly deposited his lunch in the nearest waste basket. The cause? Well, he was on the wrong side of a highly speculative investment and witnessed his profits on the trade, the year, and his bonus quickly disappear.

The stock market possesses an uncanny ability to strike both fear and greed into the hearts of those who behold it, and this roller coaster of emotions is the subject of our thoughts today.

Truth in Data

Speaking to a lot of people about their finances, I know the last five years have felt like the wrong sort of roller coaster. As the Federal Reserve raised rates going into the fourth quarter of 2018, the market reacted negatively, losing 20% in the final few months of the year (CNBC).

From that doom and gloom headline, the market proceeded to rally 35% over the next year and closed at an all-time high before the coronavirus and subsequent policies drove it down 32% in one month (NPR).

Government stimulus and better than feared outcomes drove the market higher that year to a rally that lasted until the end of 2021. The world then began to unwind some of the stimulus policy that was pushing inflation higher and 2022 was one of the worst years for investing in the last 100 (IBD).

Here we are, a year later...

The markets again have shown resilience and roared back to just under all-time highs at the writing of this article. When looking at the IBD headline, Stock Market's $1.6 Trillion One-Day Implosion Reveals A Problem, with the luxury of hindsight, several things become painfully obvious.

I. Averages are Deceiving

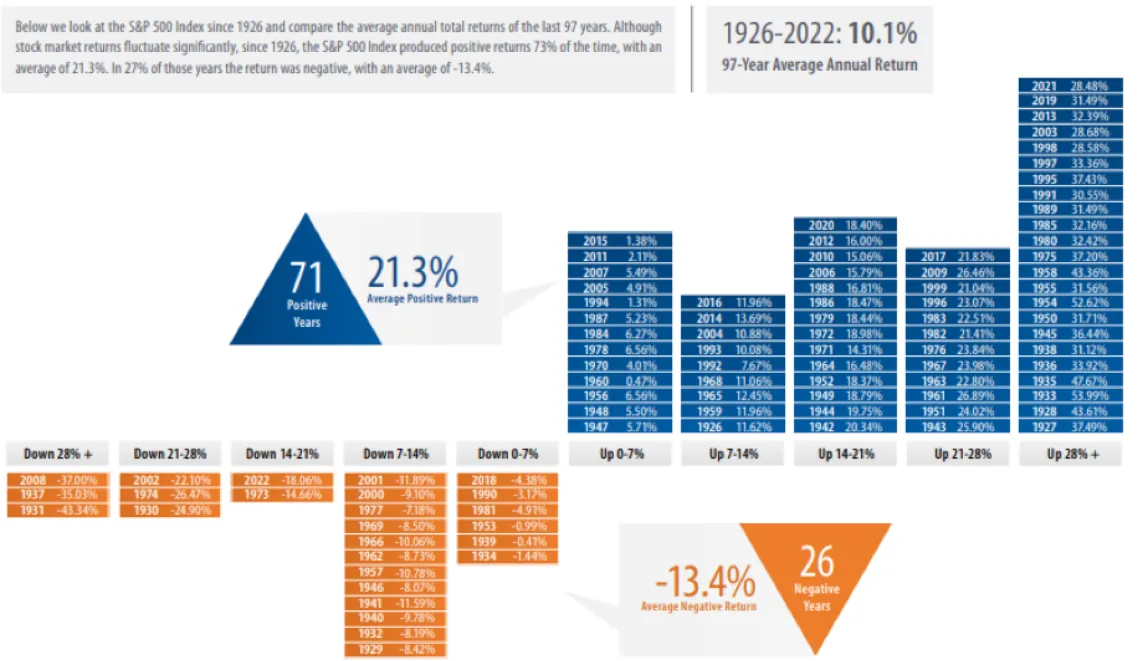

While the market may average a return of 10% a year, averages are extraordinarily deceiving. Looking at the chart below, we notice that very few years are around the average, there are very few large negative years, and there are very many highly positive years.

II. Headlines

Headlines are often written to strike fear or greed, inducing you to click on the article or buy the newspaper. Let’s face it, journalists are best off when you stay engaged with their content and are incentivized to write this way.

III. The Market and Emotions

We should never let emotions get the best of us. The market is prone to large swings on the higher and lower side of things. This is the mania of crowds, people letting their emotions take control. Had you panicked at the end of 2018, 2020, or 2021, you would have foregone the subsequent rallies. Long term, the market is undefeated at regaining all-time highs despite headlines and events.

IV. The Importance of Planning

We should have a plan. I think being opportunistic or not panicking is infinitely easier when we have built out a plan to make sure that despite the ups and downs, we are on track to meet our goals. There are going to be days that are unforeseeably bad... and good. When you know that you are still on track, it helps you breathe easier.

V. Fear vs. Greed

Be fearful when others are greedy, and greedy when others are fearful. While we should not be treating our portfolio like a light switch and turning it on and off, fully invested or 100% cash, there are clearly opportunities for active and diligent investors.

Most recently, in 2022 while the headlines were dire and big tech was “uninvestable and dead” ($4.7 Trillion Gone! Has Megacap Tech Peaked?) we took a position in our favorite stocks that were being unfairly treated in the markets. We bought names like Nvidia, Amazon, Microsoft, Google, and Apple. Our thesis was simple: these are world-class companies that are down over fifty percent this year and with time, they will rebound. All have rallied and beaten the market this year.

Without a doubt, the question I will get from this article: the above is all great but what should I be doing today?

First and foremost, we should have a financial plan that delineates what our ultimate goal is and how might we best get there. Once we have a north star to guide us, we can adjust our portfolios to meet the goal. A deep dive into your portfolio is a must at this juncture because if recent history is indicative, the gains from this year will give way to volatility at some point and the best antidote is being proactive.

Sources

- CNBC Headline December 24th, 2018: By the numbers: Stock market collapses on Christmas Eve, heads for worst December ever

- NPR Headline March 16th, 2020: Stocks Go Into Shock. Dow Plunges Nearly 3,000 Points

- IBD Headline September 9th, 2022: Stock Market's $1.6 Trillion One-Day Implosion Reveals A Problem