TABLE OF CONENTS

I. Introduction: The Financial Reality of Medicine

II. Back to School: Student Loans 101

III. Federal Student Loans: A Closer Look

IV. Private Student Loans: What You Need to Know

V. Refinancing: A Strategic Move

VI. Loan Forgiveness Programs: An Opportunity

VII. Student Loan Deferment and Forbearance: Think Twice

VIII. Managing Cash Flow: A Balanced Approach

IX. Emergency Fund and Savings: Don’t Overlook

X. Conclusion: Financial Wellness in your Medical Career

I. Introduction: The Financial Reality of Medicine

As you begin your medical career, there is lots of excitement and maybe a little anxiety. There are so many new things to learn in this chapter. Your life is so different that you must pinch yourself to wake up from your daydream, reminding you that you probably need to get some sleep. As you doze off, there is a noise under the bed… you look and a behemoth of a monster is staring right back at you, your student loan statement. With a hunger for money, this beast is one that will need to get fed eventually.

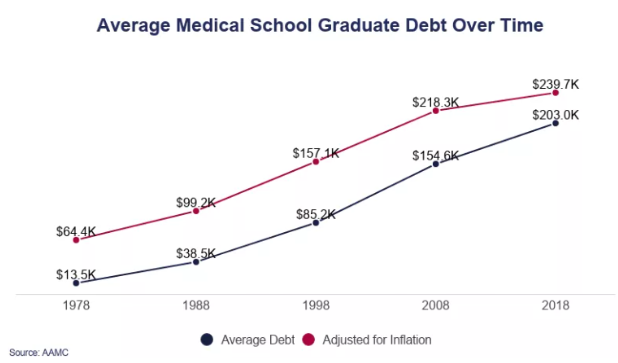

Welcome to the world of medicine, a journey marked not only by the pursuit of healing and care but also by the significant financial commitments involved, especially in the form of student loans. The average doctor graduates with approximately $250,000 of student loan debt. This can seem like an insurmountable figure without a plan, even with a fresh six-figure salary. This problem has only become more prevalent with average debts rising from 13.5k in 1978 to 203k for just medical school! In this article, we will explore effective strategies for managing your student loans and overall debt to set a solid foundation for your financial future.

II. Back to School: Student Loans 101

The first step in managing your debt is understanding it. Know the types of loans you have (federal or private), their interest rates, and repayment terms. Federal loans often offer more flexible repayment options and forgiveness programs, which can be vital in formulating your repayment strategy.

III. Federal Student Loans: A Closer Look

Federal loans generally have lower rates and also have special income-based payment plans and forgiveness plans. The general rule is to max out what you can borrow in the federal loan programs before taking on any private loans.

Federal student loans can be consolidated. In this process, numerous loans are all lumped together into one loan, and the interest rates are averaged and then rounded up to the nearest 1/8th of a point. This is distinct from the process of refinancing (available only with private lenders) where the interest rate is generally lowered.

IV. Private Student Loans: What You Need to Know

Private loans are typically taken out by students who have already borrowed the maximum federal loans for the year. However, with Grad PLUS loans, that should not be the case anymore and federal loans should always be taken out over private. One exception is for students attending some international medical schools who are NOT eligible for federal loans at all. Private loans will be the only option for students in this situation.

V. Refinancing: A Strategic Move

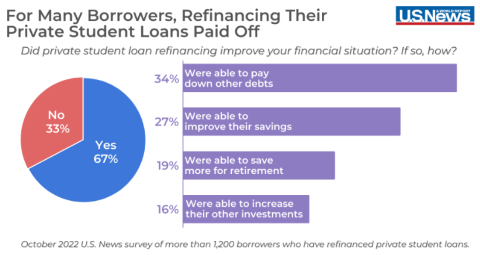

Refinancing can be a powerful tool especially if you have high-interest private loans. By refinancing, you might secure a lower interest rate, which can save you thousands of dollars over the life of the loan. However, be cautious if considering refinancing federal loans, as you may lose benefits like income-driven repayment plans and potential loan forgiveness. That said, more medical professionals should take advantage of refinancing options as only 20-25% of medical professionals refinance their student loans at some point during their career, seeking better interest rates and terms.

As a general rule, doctors are going to pay back their private student loans, so minimizing the interest that accrues is key. The best way to do this is to refinance those student loans as soon as you get out of medical school. The secret to refinancing your student loans is to do it early and often.

While it may appear intimidating at first, most companies will give you an accurate estimate of the rate you will eventually receive in about two minutes online. You will need to gather and submit some paperwork, but it is mostly the same between companies that offer this service. Once you gather the information and submit it to one, it is very easy to submit it to two or three more (or even all of them). Then, just take the one that offers the lowest rate!

VI. Loan Forgiveness Programs: An Opportunity

As a medical professional, you may qualify for various loan forgiveness programs. The Public Service Loan Forgiveness (PSLF) is particularly relevant if you work in a non-profit or government setting. Under PSLF, your federal student loans can be forgiven after 120 qualifying payments. Other programs are available for those working in underserved areas or specific medical fields.

If your debt-to-income ratio is high, consider an income-driven repayment plan for your federal loans. These plans adjust your monthly payments based on your income and family size, potentially making your payments more manageable in the early stages of your career.

VII. Student Loan Deferment and Forbearance: Think Twice

Many residents are tempted to put their student loans into deferment or forbearance during residency and/or fellowship. This is almost always a mistake. A rather grim encounter can be found with a doctor who is two to three years shy of receiving PSLF, but they opted for loan forbearance during a lengthy training period. I hate bearing bad news that they have basically thrown away a benefit worth hundreds of thousands of after-tax dollars. It’s as if they had worked for a year or two as a doctor without being paid. Deferment is slightly better than forbearance for some people, but the two are very similar for most high-income professionals with loans. You make no payments but the debt continues to grow, sometimes very quickly.

VIII. Managing Cash Flow: A Balanced Approach

Effective cash flow management is crucial. Create a budget that prioritizes loan repayments without neglecting your other financial goals and living expenses. Consider the ‘snowball’ or ‘avalanche’ methods for paying off debts. Focusing on the smallest debts first or those with the highest interest rates will be better for you in the long run. Paying off mountains of debt can be a foreboding task, the key is to live frugally in the first few years you have a higher income. This way you will not fall victim to early lifestyle creep or lifestyle inflation. This can be difficult as delaying gratification after years of medical school and residency can just seem too spartan.

IX. Emergency Fund and Savings: Don’t Overlook

While focusing on debt, don’t forget to build an emergency fund and save for retirement. An emergency fund covers unexpected expenses without derailing your debt repayment plan, and early retirement savings take advantage of compound interest over time. You really have to strike a balance here and understand your student loan interest rates versus the expected return of the market.

X. Conclusion: Financial Wellness in your Medical Career

Managing student loans as a new medical professional can be daunting. However, with the right strategies, it’s far from impossible. Refinancing, taking advantage of forgiveness programs, managing cash flow effectively, and balancing debt repayment with savings are all key components of a sound financial plan.

Remember, your journey in medicine is not just about caring for others; it's also about taking care of your financial health. As you embark on this exciting career, know that you're not alone in navigating these financial waters. Feel free to reach out for personalized advice and guidance tailored to your unique situation.