TABLE OF CONENTS

I. Introduction

II. Understanding Your Retirement Savings Options

III. Employer Retirement Plans

IV. Individual Retirement Accounts (IRAs)

V. SEP IRAs and Solo 401(k)s

VI. Roth vs. Traditional Accounts

VII. Tax Diversification

VIII. The Importance of a Comprehensive Financial Plan

IX. Conclusion

I. Introduction

Whether you are just donning your white coat or have been in the medical field for more years than you would like to count, retirement planning should be a priority. Neglecting to regularly review and update your retirement plan can turn what seems like an oasis into a mere mirage. As a dedicated medical professional, you have spent countless hours improving others' well-being but remember, the cobbler’s children often have no shoes. Now, it's time to focus on your financial health.

II. Understanding Your Retirement Savings Options

Navigating the retirement savings landscape can be overwhelming, with a plethora of options and acronyms. As individuals embark on the journey of planning for their golden years, the array of retirement savings vehicles — from 401(k)s and IRAs to Roth options —often presents a formidable challenge. Deciphering the intricacies of each option becomes crucial for informed decision-making, and we are here to assist with this task.

III. Employer Retirement Plans

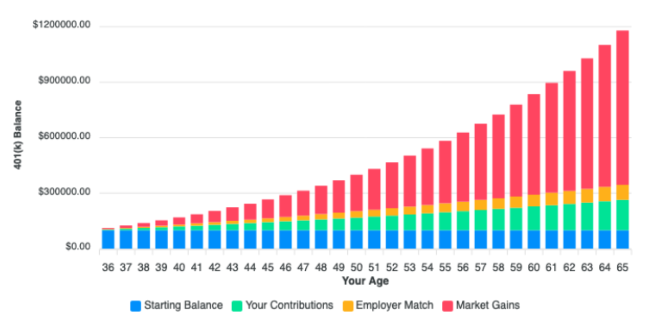

For many physicians, 401(k)s and 403(b)s form the cornerstone of retirement savings. Particularly for those in larger healthcare organizations, these plans offer immediate tax benefits, tax-free growth, and often, employer-matching contributions. Keep in mind, the funds in traditional 401(k)s are taxed upon withdrawal. To mitigate this, consider the increasingly popular Roth 401(k), which allows for tax-free withdrawals in retirement. However, accessing these funds before the age of 59 and a half can lead to penalties.

Invest early and often! Contributing the maximum amount, for instance, $22,500 in 2023, can significantly impact your retirement savings. With an 8% growth rate over 30 years, this could amount to over $2.5 million.

IV. Individual Retirement Accounts (IRAs)

IRAs offer similar tax advantages to 401(k)s. They are an excellent option for ensuring tax-free growth, though they come with early withdrawal constraints and their deductibility for tax purposes may be limited by your income.

V. SEP IRAs and Solo 401(k)s

If you are self-employed or run your practice, do not overlook SEP IRAs or Solo 401(k)s. These plans often allow higher contribution limits than standard IRAs or 401(k)s.

VI. Roth vs. Traditional Accounts

One common question is whether to choose Roth or Traditional accounts. The choice often depends on your current tax bracket and anticipated retirement tax bracket. Younger professionals, especially residents, might find greater long-term benefits in Roth accounts, given their current lower tax bracket.

VII. Tax Diversification

A critical mistake many physicians make is not diversifying the tax nature of their retirement accounts. Relying solely on traditional 401(k)s can limit flexibility in retirement and increase tax liabilities. A balanced approach with traditional, Roth, and taxable accounts is advisable.

VIII. The Importance of a Comprehensive Financial Plan

A well-thought-out financial plan is essential. It should serve as your financial compass, encapsulating retirement savings, overall financial goals, tax situation, risk tolerance, and estate planning. Efficient tax planning is crucial for physicians, who often find themselves in higher tax brackets.

IX. Conclusion

You have invested immensely in your medical career; ensure your retirement planning reflects that effort. A balanced mix of retirement accounts, understanding each option's nuances, and supplementing with after-tax investments are vital for a comfortable retirement. The sooner you start, the more you benefit from compounding interest. Your journey to a healthy retirement can start today!