TABLE OF CONENTS

I. Introduction

II. Understanding Your Tax Bracket: The Foundation of Financial Wellness

III. Maximizing Retirement Contributions: A Powerful Tax-Saving Tool

IV. Balancing Retirement Contributions with Liquidity Needs

V. The Power of Roth 401(k)s for Young Physicians

VI. Exploring HSA and FSA Options: Tax-Efficient Healthcare Spending

VII. Investment Portfolio Efficiency: Avoiding Tax Pitfalls

VIII. Charitable Giving: Philanthropy Meets Tax Planning

IX. Deductions for Private Practice: Maximizing Business Expenses

X. Income Splitting Strategies: Family Trusts and Employing Family Members

XI. The Importance of Professional Tax Advice

XII. A Word of Caution: Beware of Tax Reduction Schemes

I. Introduction

Benjamin Franklin's timeless wisdom - "Nothing is certain but death and taxes" - resonates profoundly in the medical profession. As a physician, you are accustomed to confronting both. However, while you expertly manage life and health, navigating the labyrinth of taxes can be equally daunting. This guide, while not exhaustive, aims to shed light on tax strategies pivotal for safeguarding your financial health, much like how diet and exercise safeguard physical health.

II. Understanding Your Tax Bracket: The Foundation of Financial Wellness

Knowing your tax bracket is the cornerstone of effective tax planning. This knowledge is invaluable for evaluating the benefits of various tax strategies. For those in the highest tax brackets, reducing taxable income by even a dollar saves 37 cents in taxes. Grasping this concept is crucial for making informed decisions about income deferral, investment choices, and retirement planning.

III. Maximizing Retirement Contributions: A Powerful Tax-Saving Tool

For medical professionals, maximizing retirement contributions is a straightforward yet effective strategy to lower taxable income. This includes 401(k)s, 403(b)s, IRAs, and for private practitioners, SEP IRAs or Solo 401(k)s with their higher limits. Maxing out a SEP IRA contribution limit of $66,000 will save you about $24,420 if you are in the top tax bracket. This is an immediate benefit today in taxes and a long-term benefit in that those dollars grow tax-deferred.

IV. Balancing Retirement Contributions with Liquidity Needs

It is crucial to strike a balance between tax savings and liquidity needs, as retirement funds typically lock away your money until you reach 59.5 years. Planning for a diversified retirement portfolio is essential, especially considering the tax implications of withdrawing from traditional IRAs and 401(k)s.

V. The Power of Roth 401(k)s for Young Physicians

Young doctors in lower tax brackets should consider Roth 401(k)s. The tax-free growth and withdrawals they offer can far outweigh the immediate tax savings, making them a wise choice for long-term financial planning.

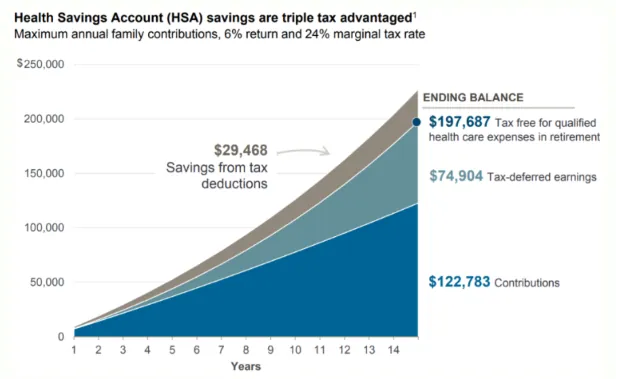

VI. Exploring HSA and FSA Options: Tax-Efficient Healthcare Spending

HSAs and FSAs offer triple tax advantages: deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses, making them invaluable tools for medical professionals.

VII. Investment Portfolio Efficiency: Avoiding Tax Pitfalls

Many physicians overlook the tax efficiency of their investment portfolios. Proactive strategies like tax-loss harvesting and avoiding high-fee, tax-inefficient mutual funds can significantly reduce your tax liability. For example, if you buy $100 in American Airlines stock and it goes down by 20% to $80 in value, you can sell it, realize the loss, and buy Delta stock to get a comparable upside. If you really like American Airlines, you can ultimately buy it back after 30 days and still reap the tax benefit. You or your advisor should be proactively searching for these tax-saving opportunities throughout the year, not just in December.

VIII. Charitable Giving: Philanthropy Meets Tax Planning

Charitable giving not only fulfills philanthropic goals but can also provide significant tax benefits. Donations to qualified charities are tax-deductible and can be a strategic way to reduce taxable income, especially if you itemize deductions. As with retirement planning, Charitable giving should be part of the greater financial plan and not done solely in a vacuum. Often, I analyze how much can be given to lower a doctor’s tax rate down to the previous bracket. This strategy offers the most bang for your buck with giving.

IX. Deductions for Private Practice: Maximizing Business Expenses

For those running a private practice, a plethora of business expenses, including office rent, equipment, staff salaries, and professional development costs, are deductible. Understanding and properly documenting these expenses is key to minimizing your tax burden.

X. Income Splitting Strategies: Family Trusts and Employing Family Members

Income splitting, through family trusts or employing family members in your practice, can be an effective way to lower your overall tax liability by distributing income into lower tax brackets.

XI. The Importance of Professional Tax Advice

Tax laws are intricate and constantly evolving. Collaborating with a tax professional or financial advisor who comprehends the unique challenges of the medical profession can result in significant savings and a more effective tax strategy. Remember, in both medicine and finance, prevention is better than cure. Proactive tax planning ensures you're not just saving lives but also efficiently conserving your hard-earned income.

XII. A Word of Caution: Beware of Tax Reduction Schemes

Lastly, be cautious of schemes promising substantial tax reductions. Products like esoteric real estate investments, permanent life insurance, and annuities often come with hidden pitfalls and should be approached with skepticism.